Donna auto title loans provide rapid financial assistance secured by a borrower's vehicle title, offering competitive rates and flexible terms. Streamlined application process requires minimal documentation. State regulations protect borrowers and lenders with fair practices, ensuring vehicle ownership during the loan period. Online applications lead to quick approval and immediate cash disbursement, ideal for emergency expenses. Repayment plans are structured, but understanding terms is vital to avoid penalties or repossession risks.

“Explore the world of Donna auto title loans and gain a comprehensive understanding of this unique financing option. In this guide, we navigate the ins and outs of state-regulated auto title loans in Donna, offering borrowers and lenders alike a clear view of their rights and responsibilities. From application processes to repayment terms, we break down the loan journey. By delving into these regulations, individuals can make informed decisions regarding short-term funding, ensuring a secure and beneficial experience.”

- Understanding Donna Auto Title Loans: A Comprehensive Guide

- State Regulations: Protecting Borrowers and Lenders Alike

- Loan Process: From Application to Repayment

Understanding Donna Auto Title Loans: A Comprehensive Guide

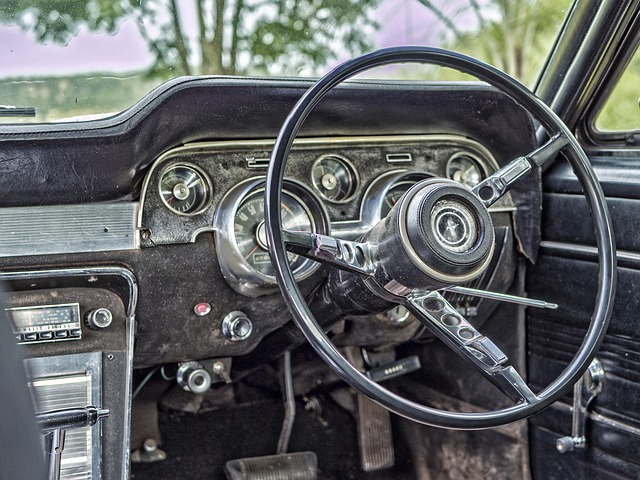

Donna auto title loans have gained popularity as a quick solution for individuals seeking fast cash. These loans are secured by the borrower’s vehicle title, allowing lenders to offer competitive interest rates and flexible payment terms. Unlike traditional loans that require extensive credit checks, Donna auto title loans focus more on the value of the vehicle than the borrower’s credit history. This makes them accessible to a broader range of people, including those with low or no credit.

The process is typically straightforward. Borrowers simply need to provide their vehicle’s title, a valid driver’s license, and proof of insurance. Once approved, they can receive fast cash within hours, providing much-needed relief during financial emergencies. Moreover, flexible payment options allow borrowers to repay the loan at their own pace, making it an attractive alternative to conventional loans. This comprehensive guide ensures that individuals considering Donna auto title loans have a clear understanding of this unique financing option.

State Regulations: Protecting Borrowers and Lenders Alike

State regulations for Donna auto title loans are designed to protect both borrowers and lenders. These laws ensure that the process is fair and transparent, providing clear guidelines on interest rates, repayment terms, and collection practices. In Texas, where San Antonio loans are prevalent, the Office of the Attorney General oversees consumer credit, including auto title loans, to prevent predatory lending practices.

One key benefit for borrowers seeking a no-credit-check loan is that state regulations mandate lenders to conduct a reasonable inquiry before approving a loan. This means your ability to repay won’t be the sole factor; your vehicle’s value and its lien history will also be considered. As a result, you keep your vehicle during the loan period, ensuring flexibility and peace of mind.

Loan Process: From Application to Repayment

The process of obtaining a Donna auto title loan is designed to be efficient and straightforward. Potential borrowers can start by filling out an online application, providing details about their vehicle—make, model, year, and current mileage—and personal information. Once submitted, a representative will review the application and, upon approval, contact the borrower for further discussion on terms and conditions. This quick approval process enables individuals to access funds in a timely manner, making it an attractive option for emergency expenses or unexpected financial needs.

Repayment for these loans typically involves structured payment plans tailored to the borrower’s budget. Customers can opt for regular installments over a set period, ensuring manageable monthly payments. The loan is secured against the vehicle title, providing peace of mind and a safety net in case of unforeseen circumstances. Borrowers should be mindful of the interest rates and fees associated with these loans, as they vary among lenders. Understanding these terms and adhering to the repayment schedule is key to avoiding potential penalties or repossession risks.

Donna auto title loans have emerged as a viable financial option, offering quick access to cash for those in need. However, it’s crucial to understand that state regulations play a pivotal role in protecting both borrowers and lenders. By navigating the loan process, from application to repayment, individuals can make informed decisions while leveraging the benefits of Donna auto title loans securely and responsibly.